1

Project overview

2

Client Analysis

3

Staking Analysis

4

Roadmap

🏅

Client Analysis - Insights

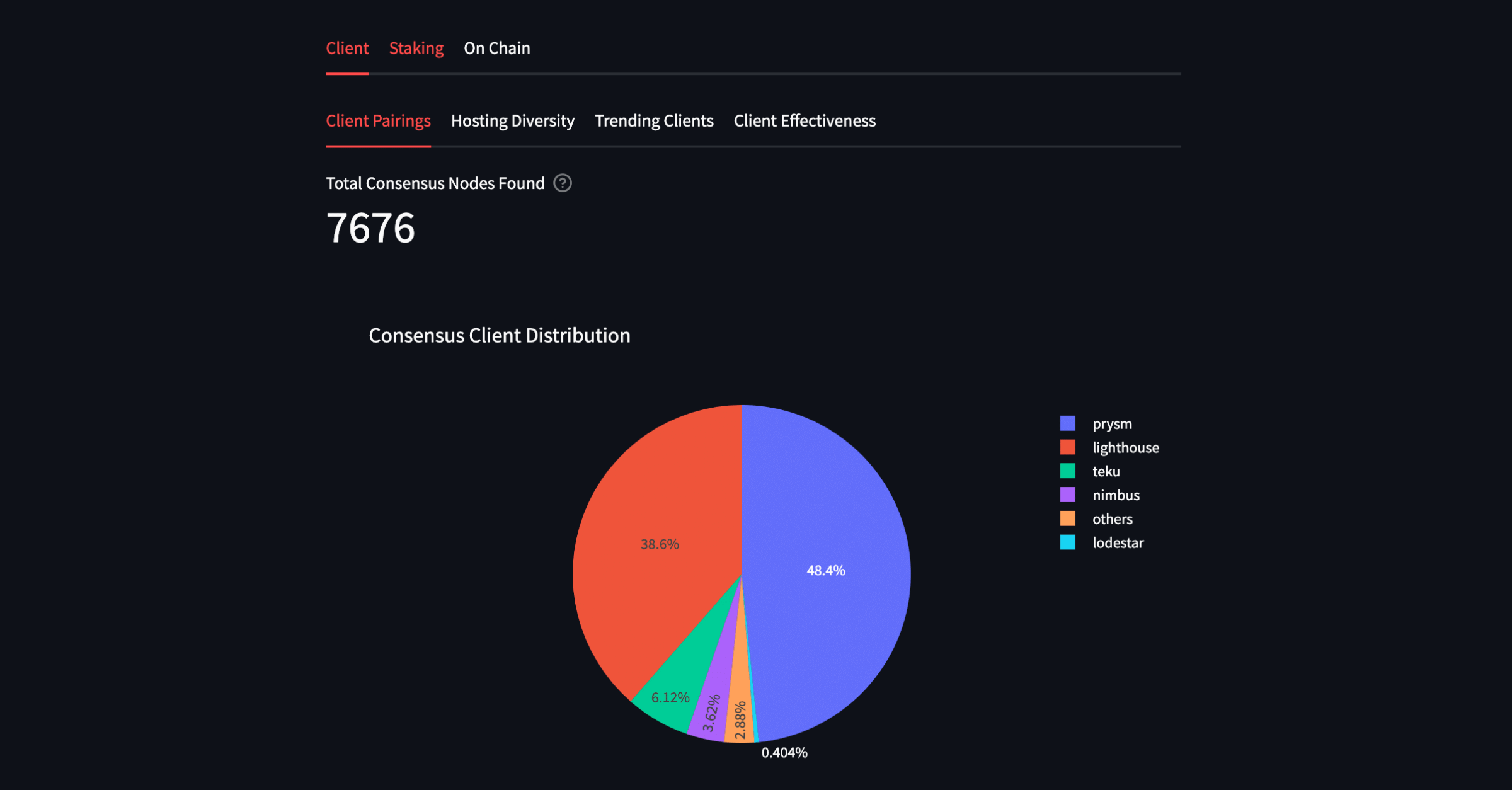

1. Consensus Client Distribution

Comparing this with the clientdiversity,

- Migalabs and Blockprint have estimated higher penetration of Teku client than by the NodeWatch crawler.

- Though all of the sources have a similar distribution, they are not identical.

ℹ️ Takeaway: Collaborate with the other teams and compare the results of different crawlers to get a more accurate estimate.

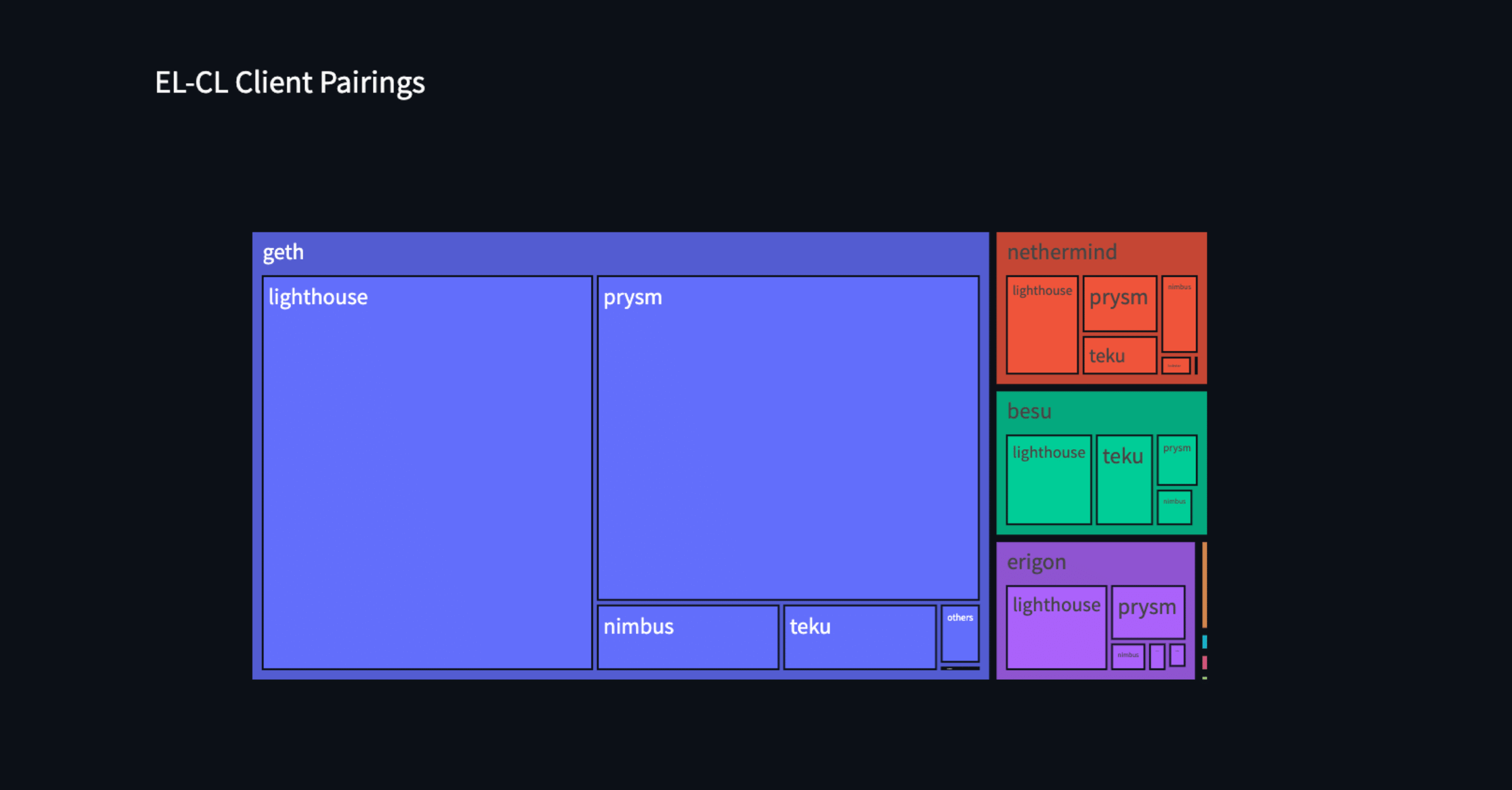

2. EL CL pairing

We were able to match EL and CL nodes based on IP for ~3500 nodes.

The goal is to identify the most popular client combinations. This would assist stakers in selecting a different client combination to maximize client diversity.

For example, even if the staker prefers Geth as EL (despite the fact that it is the dominant one), selecting a different consensus client (such as Teku) would be a better option than selecting Lighthouse or Prysm.

Furthermore, the above information would aid in the creation of installation guides for the least popular client combinations, making it easier for stakers to select them over the popular ones.

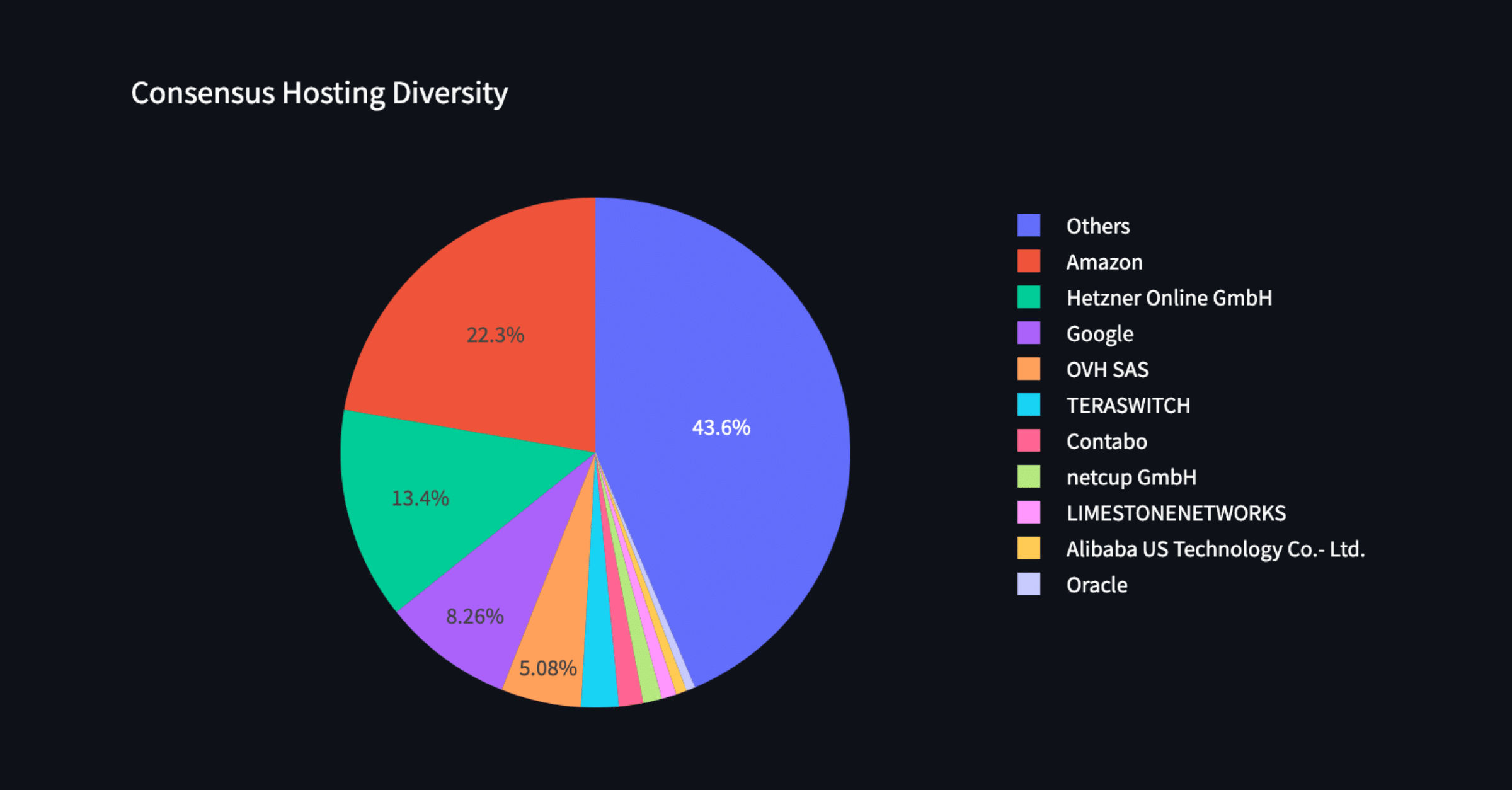

3. Consensus Hosting Diversity

It provides an overview of hosting providers' network penetration.

Despite having anti-crypto policies, Hetzner still runs more than 10% of consensus nodes.

If Hetzner begins to take it seriously, it could endanger more than 10% of the nodes (unsure of the validator%).

It would be fantastic to have a staking guide that offers alternatives to risky hosting providers.

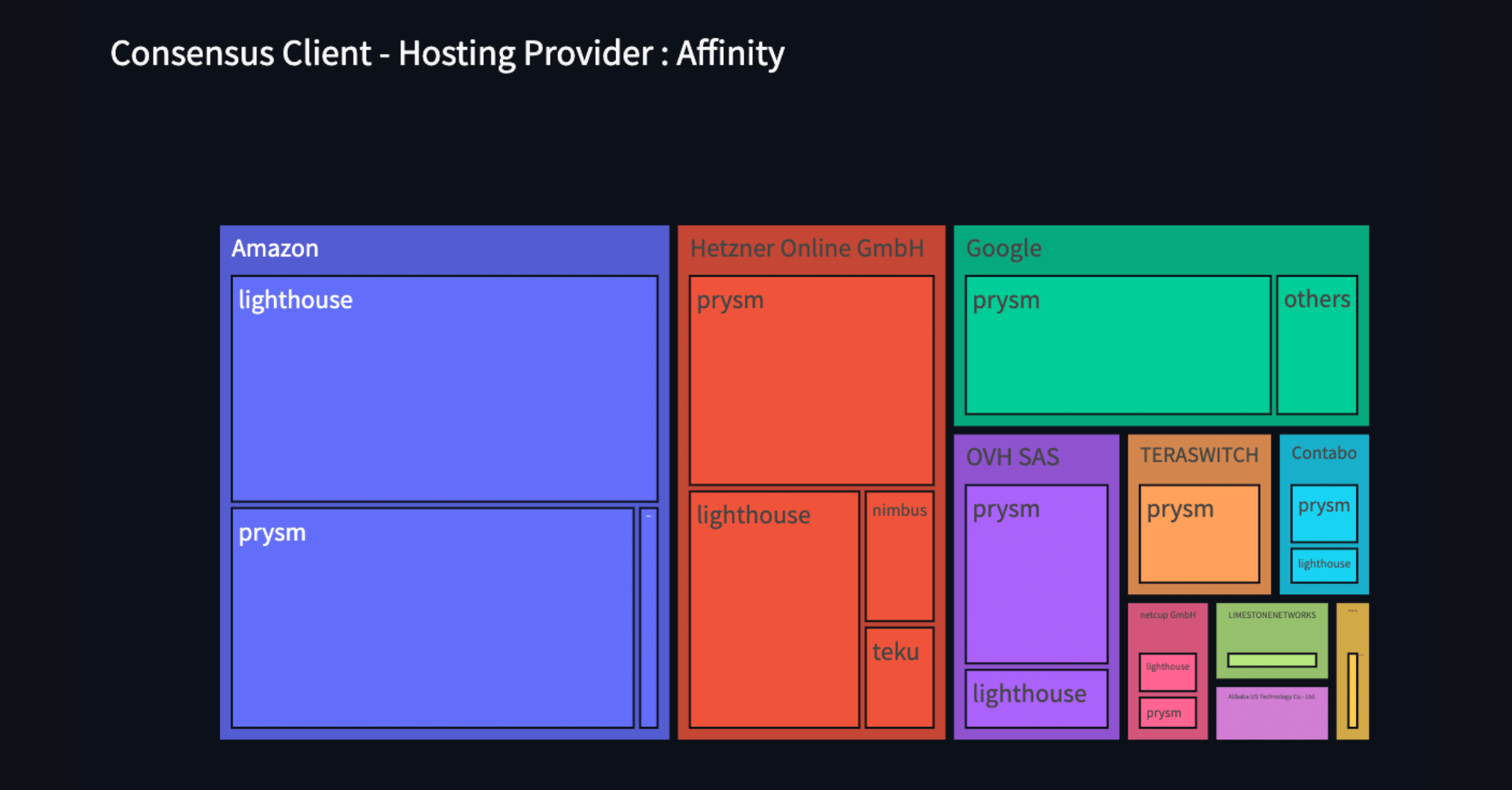

4. CL - Hosting Provider Affinity

The objective is to determine whether there is an affinity between hosting providers and clients. It appears so. Google, OVH predominantly runs Prysm nodes.

We are unsure of the actionable steps based on the information presented above. We'd love to hear from the community.

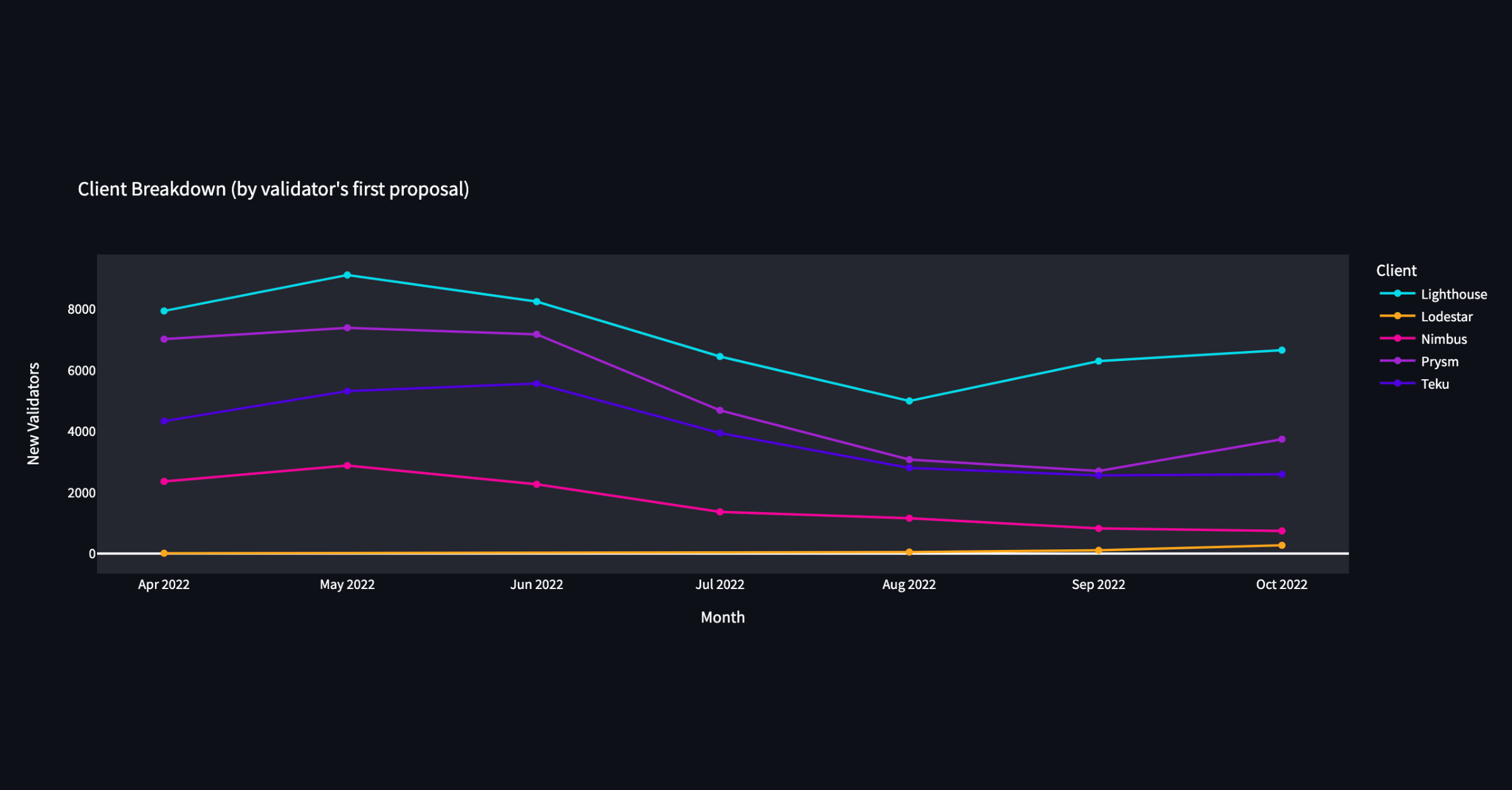

5. Trending Clients

Though we know the overall distribution of clients, Is there any way that we can understand the trend? Is there a shift in client adoption?

In order to answer the above, We need to know the new validators and their client information. However, the information pulled from nodewatch crawler does not contain any information about validators.

Fortunately, SigmaPrime has built a ML system that can predict the validator's client based on the block fingerprint. We pulled information from blockprint API to map validators to client. We identified all the first instances of a validator making a block proposal and extracted their (estimated)client info to understand the client adoption trend.

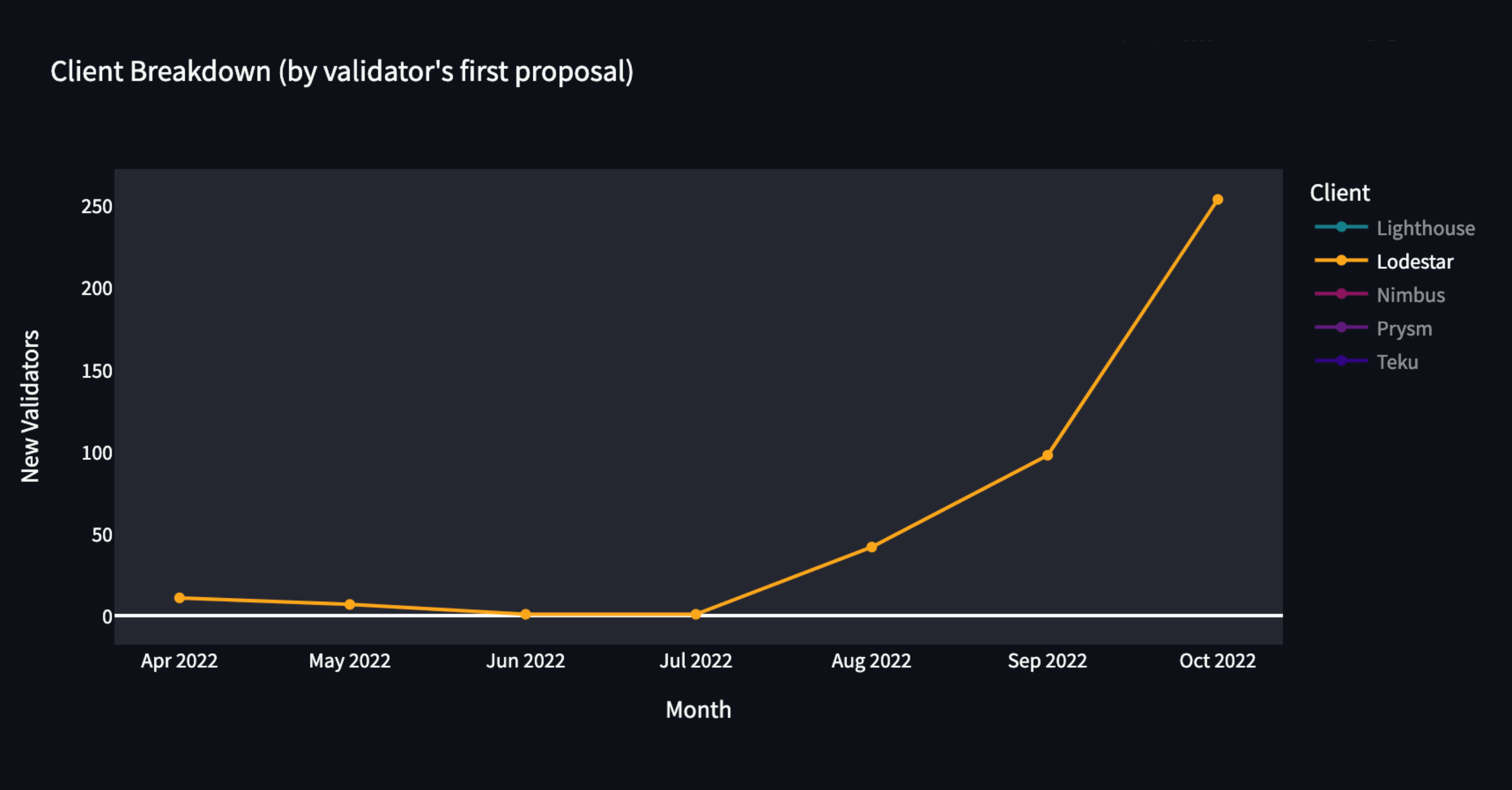

we can also filter by individual clients and understand their trend. Despite the low numbers, the chart below shows an upward trend in lodestar adoption.

We hope that this chart will provide the community with insight into client trends and enable the community to take any proactive measures.

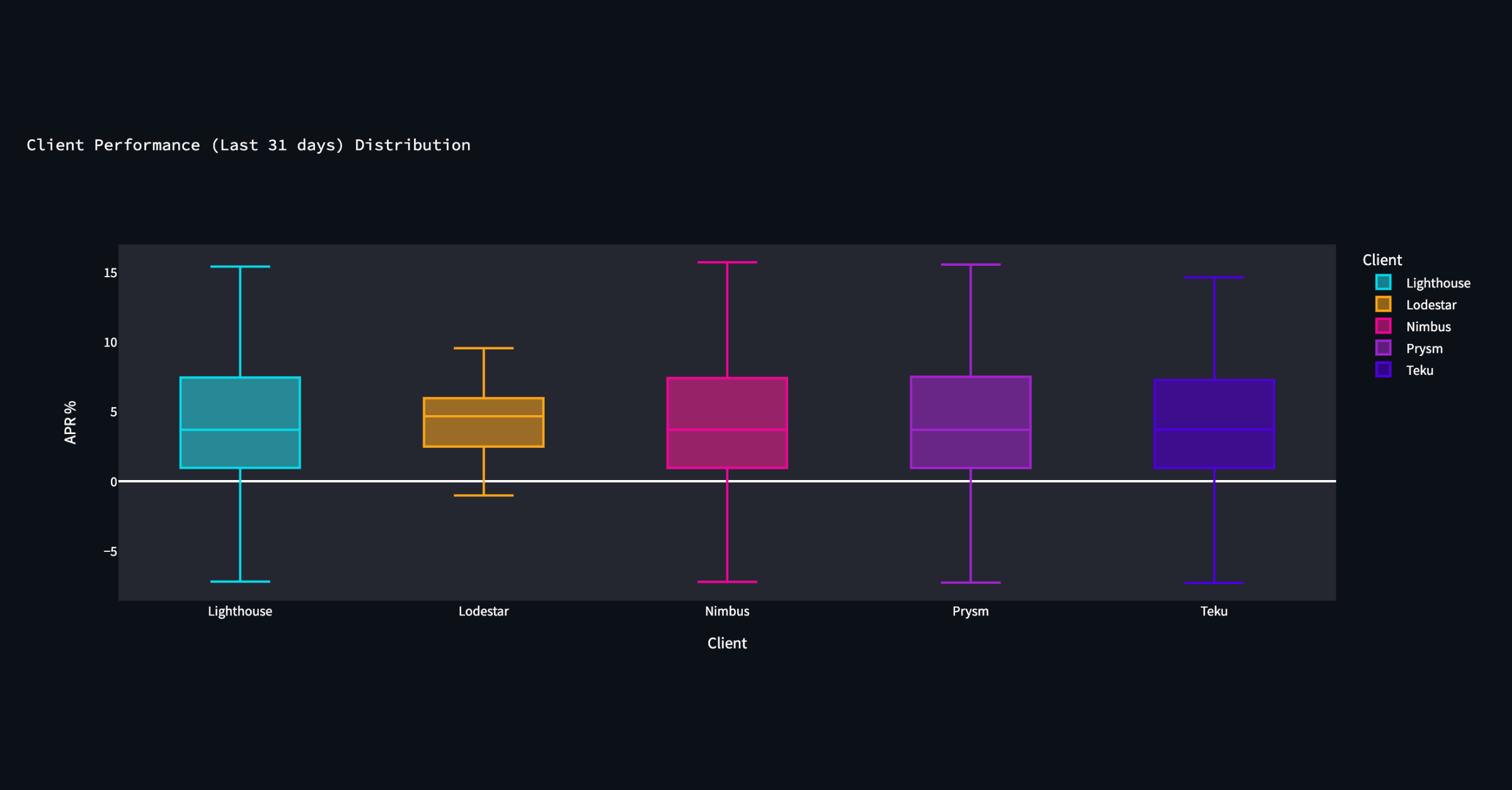

6. Client Effectiveness

Is one client performing better than the others?

APR serves as a proxy for client behaviour. We could better understand client effectiveness by investigating APR across clients.

We pulled validator's consensus reward from the beaconchain API. Using the blockprint data, we mapped the validator's reward to the client.

No significant insights observed other than Lodestar's performance. It could be due to the fact that Lodestar runs on a very small number of validators.